Financial Coaching: Helping Families Realize Their Goals and Achieve Stability

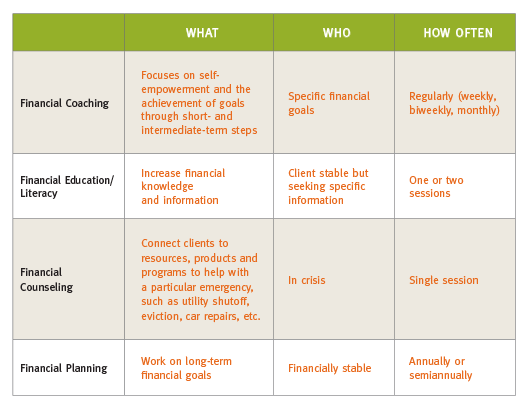

Financial counseling. Financial education. Financial literacy. Financial coaching. These terms are often used interchangeably to describe ways that people learn to manage their money, from developing a budget to saving for a big-ticket item such as a car or house.

But the reality is that they aren’t all the same. For nearly a decade, the Foundation has invested specifically in the field of financial coaching. Why? Because financial education and counseling are not enough to help families achieve stability. But financial coaching — which applies principles from positive psychology to managing one’s financial life, building on people’s innate strengths to help them develop their own solutions — is showing promising success in helping people improve their financial well-being.

Setting goals — whether the goal relates to education, career or family — is essential to achieving financial stability. Between setting a goal and achieving it, however, people need a plan, motivation and support. That’s where financial education and counseling fall short. Families struggle not because they don’t know what to do or how to do it but because they need help to change their financial behaviors to meet their goals.

In financial coaching, individuals and families identify their own goals and then work with a coach who helps them turn their aspirations into reality. A key assumption in financial coaching is that people are creative and resourceful but may need assistance in tapping into those positive attributes.

How Financial Coaching Works

Financial coaches work with clients to zero in on behaviors to improve, driven by their goals, and hold them accountable for developing concrete steps to change those behaviors. Using various techniques, they help individuals and families build their capacity to manage their own finances and sustain financial stability within their self-defined goals. Coaches provide regular feedback, support and structure for clients to develop their own solutions. In the long run, coaching helps people develop skills and habits so that they can navigate through subsequent financial situations on their own.

Yet even coaching means different things in different programs. There are no widely agreed upon standards of practice or common measures of client outcomes. The programs that offer training in coaching techniques vary in quality and intensity.

We and others in philanthropy hope to help standardize the field by building partnerships and networks focused on setting nationally accepted practices for coaching programs — and encouraging financial coaches to use them. We’re already on our way: The Center for Financial Security has developed and successfully piloted the Financial Capability Scale, a set of standardized measures.

In addition, we’ve surveyed nearly 50 organizations that offer financial coaching to better understand how it’s done and identify core practices linked to better outcomes for clients. And we are exploring a platform to monitor the take-up of financial coaching and collect data and feedback.

By coalescing around a set of measures that organizations can readily incorporate into their existing client-tracking system, funders, policymakers and other stakeholders will be able to better understand the impact of financial coaching in helping people achieve financial stability. We are also looking into supporting a professional network for practitioners to interact and exchange ideas on promising practices. For additional resources and information on financial coaching, visit the University of Wisconsin-Extension’s website on financial coaching strategies.