Families Lost Income, Struggled to Make Ends Meet During Pandemic

Approximately 40% of U.S. households with children had difficulty paying for usual household expenses from August 2020 to June 2021, according to recently released data from the Census Bureau’s Household Pulse Survey. These findings provide new details on the serious financial hardships experienced by families during the pandemic, including the disparate impacts across racial and ethnic groups and in different parts of the country.

Data Show Widespread Financial Strain, But Also Signs of Hope

Results showed that from Aug. 19, 2020, to March 15, 2021, 40%–45% of U.S. households with children from birth to age 17 reported difficulty paying for expenses such as food, housing, health care, car payments, student loans or other costs in the past week. This figure dropped to 37% in the data period ending March 29, 2021, and then fell further to 33%–34% during April–June 2021, a promising sign that financial burdens may be lessening in response to the American Rescue Plan enacted in March, as well as other government relief measures and pandemic recovery efforts in 2021.

Families Lost Income During the Pandemic

The survey also found that at least half of U.S. households with children reported that they lost employment income since March 13, 2020, when the pandemic was declared a national emergency by the U.S. government. The percentage reporting lost income hovered above 50% most of the year from late April 2020 to late March 2021, never dropping below 49%, and peaked at 56% in July 2020. The substantial proportion of households with a reduction in income may help to explain the difficulty many families experienced paying for basic living expenses during the pandemic. These findings are especially concerning given that millions of families already were living in poverty and struggling to make ends meet before COVID-19 hit.

Inequities by Race and Ethnicity

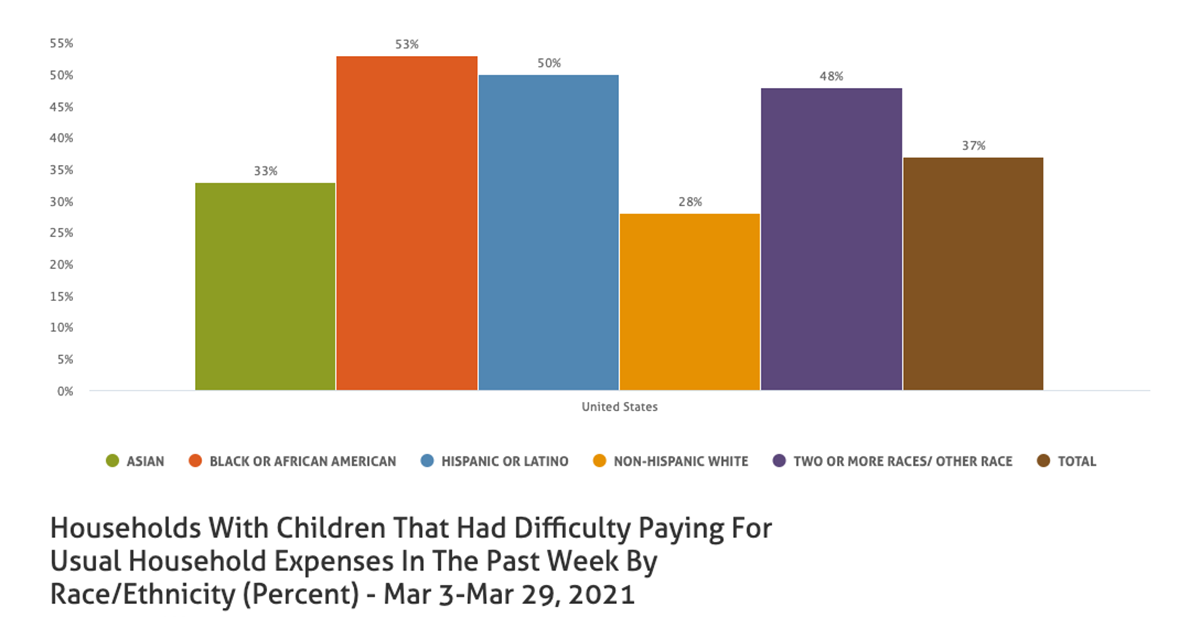

While the pandemic clearly led to widespread financial hardship, these data reveal a disproportionate burden on certain groups. Nationwide, the percentages of African American, Latino and two or more races/other race households reporting lost employment income and difficulty paying for household expenses were consistently higher than figures for white and Asian households. For example, during March 3–29, 2021, about half of African American (53%), Latino (50%) and two or more races/other race (48%) households with children had difficulty paying for usual expenses compared to only 28% of white households and 33% of Asian households.

Differences by State

Levels of financial strain varied widely across the country, as well. Several states consistently had among the highest percentages of households with children reporting difficulty paying for usual expenses throughout the pandemic: Louisiana, Mississippi, and Nevada. From April 2020 to March 2021, Nevada also had the highest share of households reporting lost employment income, ranging from 56% to 70%. However, in encouraging news, most states saw improvements on both measures during this timeframe.

Learn more about how households with children fared during the pandemic, as well as policy recommendations to strengthen child well-being, in the 2021 KIDS COUNT® Data Book and the 2020 KIDS COUNT report, Kids, Families and COVID-19: Pandemic Pain Points and the Urgent Need to Respond.