Most Common Uses of 2021 Child Tax Credit Payments: Food, Utilities, Housing, Clothes

Note: This blog post was published originally on Feb. 23, 2022, and then updated with new data on March 22, 2022.

The federal American Rescue Plan, enacted in March 2021, temporarily expanded the Child Tax Credit (CTC) to include advance monthly payments for many families from July through December 2021. These payments provided critical support during the pandemic to help parents cover basic living expenses, such as groceries and rent, or to help those struggling with debt or trying to save money.

About the Child Tax Credit Payments Data

The Census Bureau’s Household Pulse Survey gathered data on families who received these CTC payments during July–December 2021. Specifically, data was collected intermittently between July 21, 2021, and Feb. 7, 2022, and asked households with children under age 18 if anyone in the home had received a CTC payment in the past four weeks, followed by questions about use of the payments if applicable. While the most recent data collection period includes the first month of 2022, the data describe 2021 payments. The findings below cover the whole six-month timeframe unless otherwise noted.

These data are offered in the KIDS COUNT® Data Center’s special collection on COVID-19, along with other data on family experiences during the pandemic. Key takeaways about families who received CTC payments are highlighted below.

Key Findings

How Many Families Received Child Tax Credit Payments?

- About 6 in 10 U.S. households with children received CTC payments from July 21, 2021, to Jan. 10, 2022. (See data by race and ethnicity.) This figure dropped to 4 in 10 in the most recent survey period ending Feb. 7, 2022, as payments had recently ended.

- At the state level in the survey period ending Jan. 10, the share of families receiving these payments ranged from 51% in California to 70% in Iowa and South Dakota. The state range hovered around 50% to 70% throughout the July to December period.

How Did Families Use Their Child Tax Credit Payments?

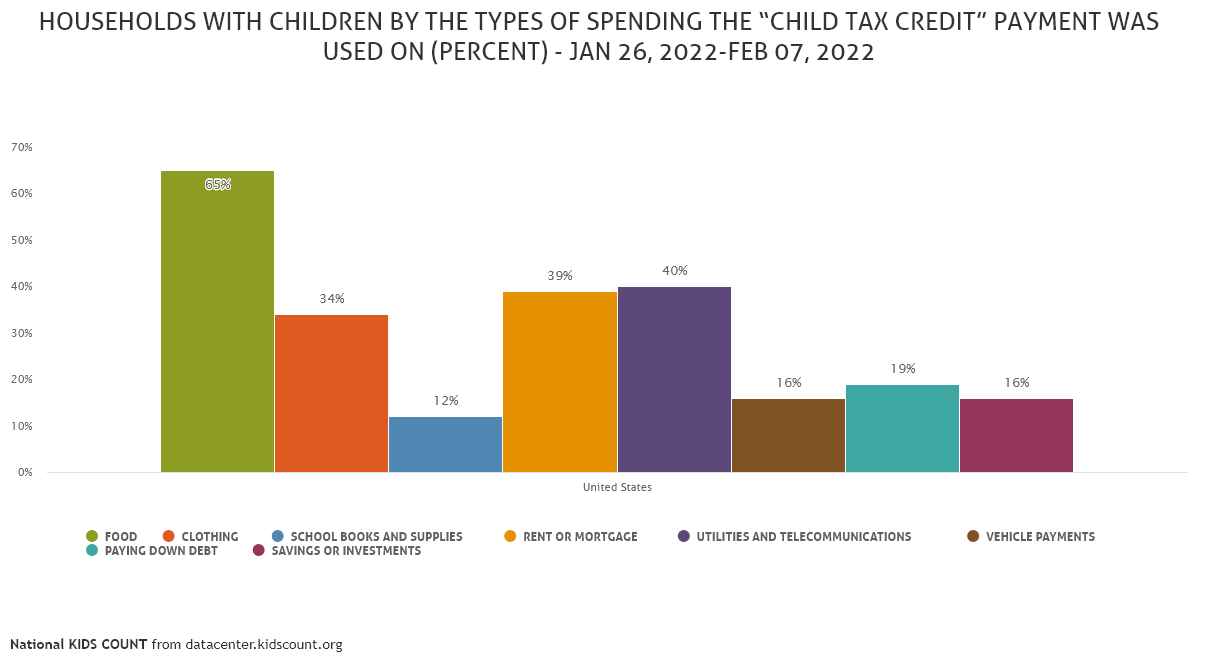

- The most common reported uses of payments were for basic needs, including food (65%), utilities and telecommunications (40%), rent and mortgage (39%) and clothing (34%). Use of CTC payments on these necessities generally increased over the six months, but purchases for food jumped substantially, from 48% to 65%. (Explore differences among racial and ethnic groups.)

- State data reflected national trends. For example, use of CTC payments for food rose in all states, except for Nevada, with the largest increase in Mississippi, from 51% to 87%.

Did Families Mostly Spend, Save or Use the CTC to Pay Off Debt?

- Over the course of the survey, the share that mostly spent their CTC payments increased from 28% to 40%, while the percentage that mostly saved their payments dropped from 32% to 23%, and the share paying down debt decreased slightly from 40% to 37%. (See data by race and ethnicity.)

Overall, the data reveal that families increasingly spent (not saved) their 2021 CTC payments, and they increasingly spent this assistance on basic needs, including food, utilities, housing and clothing. This is consistent with other data showing that a rising share of families had difficulty paying for usual household expenses in the last half of 2021. Rising rates of inflation may have added to this difficulty, as well. The pandemic has hit families hard across America, especially families of color, and millions are still struggling. These findings point to the value of and need for the expanded Child Tax Credit, which offered vital support for parents trying to provide the most basic life necessities for their children.

Learn More About the 2021 Child Tax Credit and Family Experiences During COVID-19

Access all data in the KIDS COUNT Data Center on the Child Tax Credit and family experiences during the pandemic, including data on economic well-being, employment, housing, education, child care, health care, mental health and more. Many indicators are available by race and ethnicity, as well.

For decades, the Annie E. Casey Foundation has promoted the Child Tax Credit and advocated to strengthen it, as a tool to improve the lives of children and families. Explore the Foundation’s publications, blog posts and other resources related to the CTC, family poverty and the pandemic, including this selection of recent resources:

- Blog: State Fact Sheets: How Are Families Using the Child Tax Credit? (Sept. 2021)

- Blog: The Child Tax Credit and Payments to Parents and Caregivers (July 2021)

- Blog: Families Lost Income, Struggled to Make Ends Meet During Pandemic (July 2021)

- Resource: 2021 KIDS COUNT Data Book (June 2021)

- Report: 50-State Data Report Confirms Urgent Need to Make Game-Changing Expanded Child Tax Credit Permanent (June 2021)

Stay Connected With the Data Center

Get the latest data, news and information by signing up for our newsletters.